A DYNAMIC INVESTMENT OPPORTUNITY

DESIGNED EXCLUSIVELY FOR ACCREDITED INVESTORS

Why Invest in

Self Storage?

Stable Demand

One of the defining characteristics of the self-storage industry is its stable demand. People constantly need storage space for various reasons, including downsizing, moving, or dealing with life changes like marriage, divorce, or death in the family.

This ongoing demand can provide consistent occupancy rates, which in turn could lead to steady revenue streams.

Resilience in Economic Downturns

The self-storage industry has historically shown resilience during economic downturns. In times of economic uncertainty, people often need to downsize or move, increasing the demand for storage units.

In contrast, during periods of economic prosperity, individuals tend to accumulate more goods, which may also increase the need for storage space. Thus, Class A self-storage facilities can provide a level of stability not always seen in other real estate sectors.

Low Overhead and Maintenance Costs

Class A self-storage facilities, which represent the highest quality of facilities in desirable locations, typically require less maintenance compared to other types of real estate investments.

These facilities are often newer or have been well-maintained, reducing the need for frequent costly repairs. Additionally, self-storage facilities generally have fewer utilities and no need for amenities like those required for residential or commercial buildings, which can significantly reduce operating expenses.

Leverage Our Self-Storage Experience

Legacy Builders Capital, led by experienced real estate professionals Joe Evangelisti and Brian Brogan, offers a compelling self-storage investment opportunity. There are three key strengths that make this firm stand out:

Proven Track Record: The firm has a substantial history in real estate investment, including the successful development of multiple Class A self-storage facilities. This tangible experience is a testament to their competency and industry knowledge.

Methodical Approach: Legacy Developers applies a systematic process and tactical approach to their investments. This enables effective execution and active management of each asset, aiming to generate superior risk-adjusted returns for investors.

Vertical Integration and Strategic Relationships: The firm utilizes a vertically integrated model, which, in conjunction with close relationships with third-party property management companies, allows for streamlined processes and cost control, ultimately driving value for investors.

These core strengths position Legacy Builders Capital as an appealing choice for investors interested in self-storage investments.

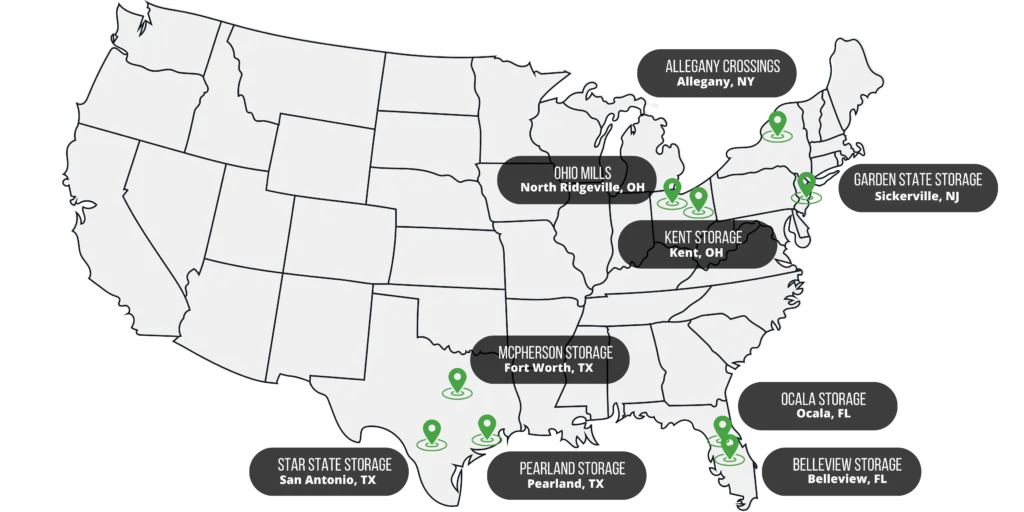

Our Portfolio

Check our most recent properties to view more information on their location, size, features, and more.

Understanding the fundamentals of Self-Storage site selection

Frequently Asked Questions

Who are Legacy Developers and Legacy Builder Capital?

Legacy Developers, LLC is developer of Class A self-storage facilities with a national presence. Our team of experienced professionals is dedicated to creating state-of-the-art storage facilities that meet the needs of our customers. With our elite team, we strive to exceed expectations and deliver projects that set the standard in the industry. Legacy Builder Capital is the brand uniting the various aspects of the Legacy universe, including the development team, acquisitions team and the fund management team. The legal name of this fund is “LEGACY DEVELOPERS FUND, LP”, which is what will appear on all reports and tax documentation. The fund is run by ”Legacy Investment Management, LLC”, an Exempt Reporting Adviser. Joe Evangelisti and Brian Brogan are responsible for execution and compliance of all associated brands under the Legacy Builder Capital umbrella.

Who qualifies to invest in the LBC Storage Fund?

Accredited Investors, as defined under the rules established by the Investment Company Act of 1940 and regulated by the Securities and Exchange Commissions (“SEC”). Accredited Investors are individuals or entities that meet certain financial criteria, including income thresholds and/or investable net worth (to exclude the value of their personal residence), and are therefore allowed to participate in certain types of private investment. (See details)

What is the purpose of the fund?

The LBC Storage Fund is a type of investment vehicle that pools capital from multiple investors to invest in self storage properties or related assets. The purpose of the fund is to provide individual investors with an opportunity to invest in a diversified portfolio of self storage assets, without the need to directly purchase, own, or manage the properties themselves.

Will I receive investor reports?

Investors will receive quarterly investor financial reports. In addition, Legacy Builder Capital will send out articles and newsletters covering self-storage topics, project updates and other company news.

What tax documents will I receive?

Investors will receive an audited form K-1 for their interest in the fund. The K-1 tax document is a form used to report a shareholder's share of income, losses, deductions, and credits from a partnership, LLC, or S corporation. It is used by the shareholder to calculate their personal tax liability for the year and is submitted to the IRS at tax time as part of the investor’s documentation package.

Are there any other tax considerations?

The fund’s managers will take advantage of all available and acceptable tax methodologies for the fund, including the use of accelerated depreciation/cost segregation upon receipt of a valid Certificate of Occupancy. These procedures may result in beneficial tax treatment in the year of their execution, which will pass through directly to the Limited Partnership investors.

Does the LBC Storage Fund accept 1031 proceeds?

No, the fund is unable to accept §1031 exchange proceeds.

Can I invest with my self-directed IRA or other retirement plan?

Yes, A self-directed IRA allows investors to have greater control over their investment options, including the ability to invest in alternative assets such as real estate.

Are there any tax implications when investing in the LBC Self Storage Fund?

Investing in a real estate fund may have tax implications. Real estate funds are typically structured as pass-through entities, meaning income generated is reported on investors' personal income tax returns. Depending on the type of income, investors may be subject to ordinary income tax rates or lower capital gains tax rates. Selling shares for a profit may result in capital gains taxes, and state and local taxes may also apply. If investing using a tax-advantaged account such as an IRA, investors may be subject to Unrelated Business Income Tax if the fund generates income from debt-financed properties or other activities not related to the account's purpose.

"Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy." - Marshall Field

"Ninety percent of all millionaires become so through owning real estate." - Andrew Carnegie

"The major fortunes in America have been made in land." - John D. Rockefeller